Why "Girl Math" Says Returning Items is Making Money (And How to Do It Right)

You’ve heard the trend. "If I pay with cash, it’s free." "If I return a $50 top, I just made $50."

While the internet loves to joke about Girl Math, there is a nugget of financial wisdom hidden inside: Refunds are revenue.

In a world where inflation is high and budgets are tight, one of the easiest ways to "make" extra money isn't a side hustle—it's simply reclaiming the money you have already spent on things you don't love.

But here is the catch: You only "make" that money if you actually return the item. If it sits in your trunk for 3 months, you didn't buy a dress—you made a donation to a billion-dollar corporation.

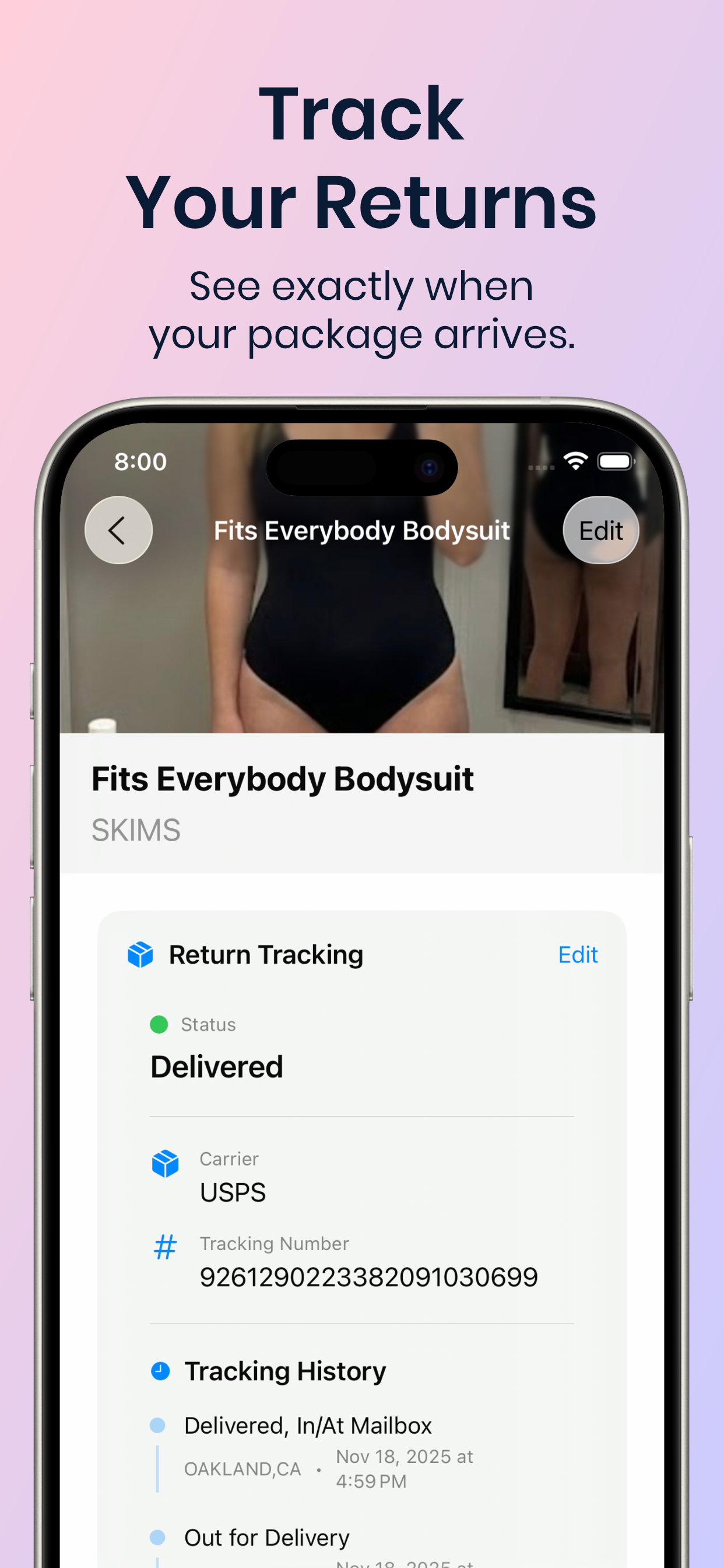

Here is how to use ReturnTrack to turn your returns into a financial wellness habit.

The Psychology of the "Return Pile"

Why do we procrastinate returns? Psychologists call it the "Wall of Awful."

The task feels overwhelming (finding the receipt, printing the label, driving to the store), so we avoid

it.

But that avoidance has a price tag.

- The "Wait and See" Cost: Keeping an item "just in case" until the return window expires.

- The "Lost Data" Cost: Forgetting where you even bought it.

The Strategy: Visualizing Your Refund Potential

You wouldn't run a business without tracking your invoices. You shouldn't run your closet without tracking your returns.

ReturnTrack turns your procrastination pile into a data dashboard.

1. See Your "Pending Balance"

Imagine opening an app and seeing a big green number: $450.00.

That isn't debt. That is the total value of the items sitting in your room right now that you plan to

return.

When you see that number, you don't see "chores." You see a paycheck waiting to be collected. That is

the motivation you need to go to the post office.

Visualize your potential refunds.

2. The "Break Even" Analysis

Girl Math rule: If you return the $200 boots, the $5 latte you buy on the way home is free.

Using ReturnTrack to secure your refunds gives you guilt-free permission to enjoy the small things,

knowing you’ve balanced your budget.

3. Voice Notes for Value

Sometimes we forget why we are returning something. Was it too expensive? Did it fit weird?

Use the Voice Note feature in ReturnTrack to leave yourself a financial reminder:

"Too pricey for the quality," or "I already have a shirt like this."

Listening to that note later reinforces your smart financial decision to send it back.

Conclusion: Organization is Wealth

Being organized isn't just about being tidy. It's about asset management.

Don't let your hard-earned money expire in a shopping bag. Track it, return it, and watch your savings

add up.

Ready to boost your budget? Download ReturnTrack and start collecting your refunds.